Sell A Business

Overview

Selling your business is a major decision and may very well be the largest financial transaction of your life.

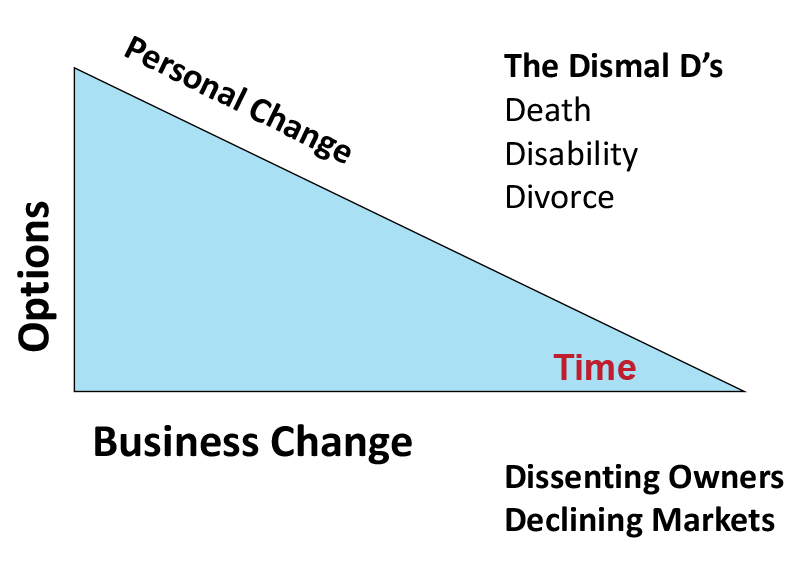

Time is not the friend of a business owner/entrepreneur.

Selling a business is a complex and patient testing process. The difference in just getting rid of the business and getting Top Market Value with the best terms will be in how well you’re represented through the sales process.

National Transaction Advisors provides the very best professional guidance you can get. We’re not transaction driven, we’re relationship driven. Our difference begins from the very start of the selling process with us asking the right and tough questions to fully understand your goals, desires, and needs. We listen first. From there we develop an accurate “go to market” value of your business and begin sourcing and presenting your business to buyers.

Our goal is to make the selling process as hassle free as possible. We’ll provide guidance and suggestions on things you may not have thought of in order to give you all the information you need to make an educated decision about the sale.

Process

The Selling Process

PLANNING

- National Transaction Advisors (NTA) Initial Meeting

- Beginning of a business relationship. Questions of the seller are answered regarding the sellers why the interest in selling and their objectives. The NTA M&A professionals explain what’s involved in the selling process. Questions of the seller are answered regarding the business operation, history and prospects of the seller’s firm.

- Review Financials

- The NTA team begins “recasting” technique to determine owner’s discretionary cash flow of the company. Spreadsheet analysis is then used to compare the three to five previous years of financial operations and the current year to date.

- Market Valuation Analysis – Go to Market Assessment

- Once the financial review is complete the NTA team works to determine a recommended selling price to the seller by researching industry comps.

- Engagement Agreement

- Once a fair market valuation has been agreed on, a sell-side mandate and agreement with the appropriate monetary amounts and any conditions agreed upon is provided to the seller for their review and signature.

- Confidential Teaser Business Review (CBR)

- After the engagement agreement is fully executed, the next step is to develop a marketing package for sellers. Developing the marketing package requires the seller to complete a business questionnaire and provide a comprehensive list of documents addressing information frequently asked by buyers.

- Seller Review & Approval of Teaser and CBR

- NTA will not market a business until the seller(s) have signed off on the accuracy of the CBR. Sellers are encouraged to thoroughly review the CBRs for any necessary corrections, clarifications, and additions.

- Beginning of a business relationship. Questions of the seller are answered regarding the sellers why the interest in selling and their objectives. The NTA M&A professionals explain what’s involved in the selling process. Questions of the seller are answered regarding the business operation, history and prospects of the seller’s firm.

- The NTA team begins “recasting” technique to determine owner’s discretionary cash flow of the company. Spreadsheet analysis is then used to compare the three to five previous years of financial operations and the current year to date.

- Once the financial review is complete the NTA team works to determine a recommended selling price to the seller by researching industry comps.

- Once a fair market valuation has been agreed on, a sell-side mandate and agreement with the appropriate monetary amounts and any conditions agreed upon is provided to the seller for their review and signature.

- After the engagement agreement is fully executed, the next step is to develop a marketing package for sellers. Developing the marketing package requires the seller to complete a business questionnaire and provide a comprehensive list of documents addressing information frequently asked by buyers.

- NTA will not market a business until the seller(s) have signed off on the accuracy of the CBR. Sellers are encouraged to thoroughly review the CBRs for any necessary corrections, clarifications, and additions.

SEARCH

- Begin Marketing the Business

- Once the CBR is completed and reviewed by the seller(s), the NTA team will begin looking for qualified buyers. An executive summary listing of the business is sent to over 150 web sites informing thousands of prospective buyers of the listing. Additionally, in working with the seller, potential buyers are identified which the NTA team begins a personal, one-on-one, outreach to along with NTA’s own network of potential buyers. Qualified buyers are not informed of the location or name of the company until first supplying a signed and dated financial summary and a confidentiality agreement.

- NTA Interviews and Filters Prospective Buyers

- Interested buyers are entered into the NTA system in relation to the company they are inquiring about. NTA will analyze the buyer profiles and speak with the buyer prospect to determine if they are appropriate to pursue in the opportunity. Prospective buyers are required to submit a signed and dated financial summary and Non-Disclosure Agreement (NDA).

- Once the CBR is completed and reviewed by the seller(s), the NTA team will begin looking for qualified buyers. An executive summary listing of the business is sent to over 150 web sites informing thousands of prospective buyers of the listing. Additionally, in working with the seller, potential buyers are identified which the NTA team begins a personal, one-on-one, outreach to along with NTA’s own network of potential buyers. Qualified buyers are not informed of the location or name of the company until first supplying a signed and dated financial summary and a confidentiality agreement.

- Interested buyers are entered into the NTA system in relation to the company they are inquiring about. NTA will analyze the buyer profiles and speak with the buyer prospect to determine if they are appropriate to pursue in the opportunity. Prospective buyers are required to submit a signed and dated financial summary and Non-Disclosure Agreement (NDA).

ENGAGEMENT

- Buyer / Seller Meeting

- The initial meeting between buyer and seller allows the buyer to tour the seller’s facility and to ask the seller questions about the operation. The buyer should be prepared to answer questions from the seller regarding their professional experience, acquisition goals, and why they feel, at least initially, that they are a good acquirer of the subject company. The initial meeting is often followed by questions from the buyer that arose as a result of both his first meeting and continued analysis of the marketing information prepared about the selling company.

- Deal Negotiations / Structuring

- The basic deal points of price and terms usually lead the way in negotiations. NTA is responsible for keeping the negotiating process moving forward and protecting the interests of the seller.

- Buyer Submits Letter of Intent (LOI)

- The Letter of Intent (LOI) to purchase, although non-binding, is the road-map by which negotiations follow. It will usually lead the parties through the due diligence process, the funding options of the buyer, and the final purchase contract which is generally drawn up just prior to closing.

- Obtain Financing

- When the buyer requires outside financing to complete the sale some things to consider. Third party lenders have their own due diligence checklists which often stretch the closing process. Other financing vehicles such as conventional loans are usually quicker. Seller financing, where applicable is usually the quickest of all funding methods often only taking weeks to a closing.

- The initial meeting between buyer and seller allows the buyer to tour the seller’s facility and to ask the seller questions about the operation. The buyer should be prepared to answer questions from the seller regarding their professional experience, acquisition goals, and why they feel, at least initially, that they are a good acquirer of the subject company. The initial meeting is often followed by questions from the buyer that arose as a result of both his first meeting and continued analysis of the marketing information prepared about the selling company.

- The basic deal points of price and terms usually lead the way in negotiations. NTA is responsible for keeping the negotiating process moving forward and protecting the interests of the seller.

- The Letter of Intent (LOI) to purchase, although non-binding, is the road-map by which negotiations follow. It will usually lead the parties through the due diligence process, the funding options of the buyer, and the final purchase contract which is generally drawn up just prior to closing.

- When the buyer requires outside financing to complete the sale some things to consider. Third party lenders have their own due diligence checklists which often stretch the closing process. Other financing vehicles such as conventional loans are usually quicker. Seller financing, where applicable is usually the quickest of all funding methods often only taking weeks to a closing.

CLOSING

- Due Diligence

- Due diligence is an investigation by the buyer of a business being purchased to confirm all facts, such as reviewing all financial records and operations plus anything else deemed material.

- Finalize Purchase Agreement

- Both parties should have their own legal and tax representatives review the final purchase agreement. This process can take time to get all parties to reach agreement about the final “definitive agreement.”

- Business Closing

- NTA is responsible for setting up the closing at a venue acceptable to all parties. Each party will receive a buyer and seller’s closing statement outlining the proceeds/expense of sale. The closing will also encompass the buyer finalizing the loan process with any third-party lenders. Closing generally takes one to three hours and is the final step in the sales process.

- Transition Period

- Most of the attention during an acquisition goes towards valuation, finances and legalities. Little notice is given to what happens in the aftermath, even though the success of an acquisition usually hinges on how the new owner handles their new responsibilities. Ultimately, the success or failure of selling a business hinges on the success of the transition of ownership.

- Due diligence is an investigation by the buyer of a business being purchased to confirm all facts, such as reviewing all financial records and operations plus anything else deemed material.

- Both parties should have their own legal and tax representatives review the final purchase agreement. This process can take time to get all parties to reach agreement about the final “definitive agreement.”

- NTA is responsible for setting up the closing at a venue acceptable to all parties. Each party will receive a buyer and seller’s closing statement outlining the proceeds/expense of sale. The closing will also encompass the buyer finalizing the loan process with any third-party lenders. Closing generally takes one to three hours and is the final step in the sales process.

- Most of the attention during an acquisition goes towards valuation, finances and legalities. Little notice is given to what happens in the aftermath, even though the success of an acquisition usually hinges on how the new owner handles their new responsibilities. Ultimately, the success or failure of selling a business hinges on the success of the transition of ownership.

FAQs

Frequently Asked Questions

Possibly. Unlike many firms in the M&A advisor field, National Transaction Advisors works with individuals and businesses interested in acquiring businesses. Additionally, National Transaction Advisors has an extensive network of high net worth individuals, corporations, and private equity groups. NTA will also perform a customized marketing plan to target qualified buyers for your company.

It generally takes, on average, between six to nine months to sell most businesses. Keep in mind that an average is just that. Some businesses will take longer to sell, while others will sell in a shorter period of time. The sooner we have all the information needed to begin the marketing process, the shorter the time period should be. It is also important that the business be priced properly right from the start. Some sellers, operating under the premise that they can always come down in price, overprice their business. This theory often “backfires,” because buyers often will refuse to look at an overpriced business.

That will vary by industry and size of the business. 70% of the buyers for small businesses are first-time buyers. Other pools of buyers are: Competitors, Vendors, Existing Employees, Investment Groups, Relatives, and Public Companies.

We recognize that in some instances, a business owner may have their own prospective buyer. Most of the time, these prospects do not move forward because the buyer and seller are unaware of the process and ultimately a deal never materializes.

National Transaction Advisors can work with the seller and the buyer to facilitate the sale of the business. The process will vary depending on the situation. We are available, at your convenience, to speak with you by phone to determine the level of service required to accomplish your goals and objectives.

Confidentiality in dealing with internal personnel and external sources is highly encouraged and is critical to achieve a successful transaction. For the Seller’s protection, National Transaction Advisors requires a Buyer’s Non-Disclosure Agreement (NDA) to be signed by the potential buyer before the release of the Confidential Business Review (CBR).

You should sell your business when you are ready and when the time is right. The following list of items will not only add value to a business but will also increase its marketability. If you are not ready, contact us today to learn how our Advisory Services can increase the value of your business.

- Increase sales annually

- Remove yourself from the business

- Develop a strong management team

- Replace family members that work in the business

- Reduce the amount of owner perks

- Sell unnecessary assets

- Reduce inventory to a manageable level

- Develop a strong sales force

- Diversify the customer base

- Develop an organizational chart

- Reduce unnecessary large purchases

- Additional steps used to prepare for a later sale

• Eliminate unproductive employees

• Develop and/or improve company website

• Have written procedures for operations (i.e. employee manuals)

• Keep you’re A/R higher than A/P

• Keep A/R within 30-60 days

You can cooperate fully with NTA and any other professionals that you are using. A buyer will want up-to-date financial information. If you use accountants, you can work with them on making current information available. If you are using an attorney, make sure they are familiar with the business closing process and the laws of your particular state. You might also ask if their schedule will allow them to participate in the closing on very short notice. Time is of the essence in any business sale transaction. The failure to close on schedule permits the buyer to reconsider or make changes in the original proposal.

And, finally, your team of advisors must all be working towards the common goal of selling your business for the best price and terms available in the marketplace, and closing the sale as quickly as possible! Remember that, as your professional Business Intermediary we are on your side. Only by being as cooperative as possible with us can we best handle your business interests.